Revolutionise credit hire claims with instant financial verification

Transform complex impecuniosity assessments into instant, accurate financial verification. Atto's open banking technology provides real-time income analysis, comprehensive affordability calculations, and fraud detection to help UK Credit Hire Organisations process insurance claims faster and more accurately. Export court-ready documentation in seconds.

Proving impecuniosity doesn't have to take days

This leaves CHOs vulnerable to prolonged verification cycles, increased dispute risks, and less confident decision-making. Closing this data gap transforms everything.

Open banking by numbers

Open banking has already made a significant impact, and the statistics below highlight its growing adoption and benefits.

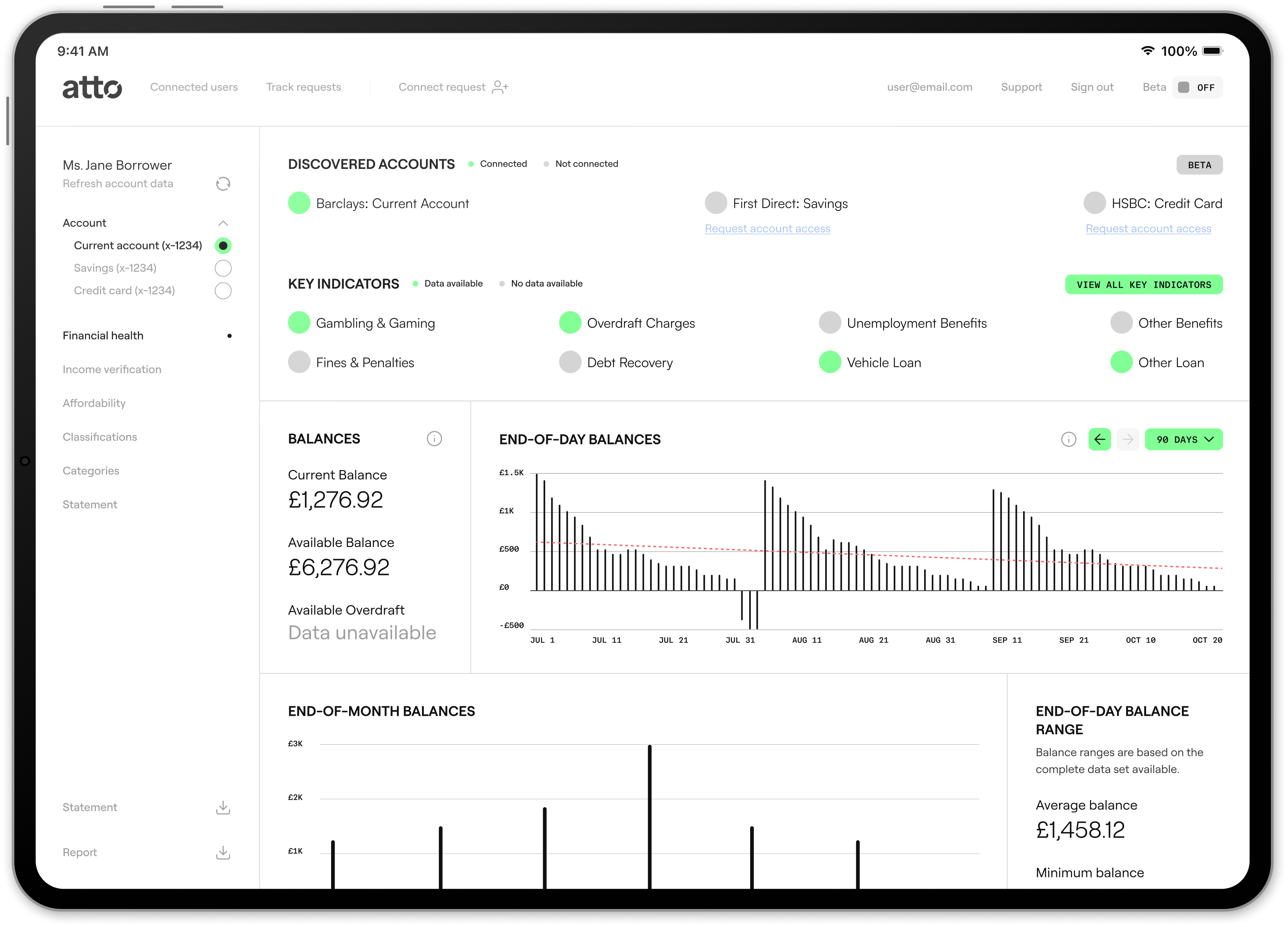

Atto ConnectThe complete picture from day one

Atto Connect now provides instant visibility into every account on a claimant's credit file before any connections are made.

Complete account visibility

See all accounts on a claimant's credit file before any open banking connections - no more surprises or hidden accounts affecting impecuniosity assessments.

Enhanced legal compliance

Demonstrate thorough financial investigation with comprehensive account discovery. Generate robust evidence for legal proceedings with complete transaction history and account status information. Export User Reports as PDF documentation ready for court submission.

Streamlined workflow

Eliminate back-and-forth requests for additional account information. Present claimants with their complete account list and guide them to connect all relevant accounts in a single session, dramatically improving efficiency.

Fraud prevention

Cross-reference declared financial circumstances against actual account holdings. Identify discrepancies between claimed impecuniosity and account ownership patterns much more effectively.

Immediate assessment

Five ways Atto improves CHO claims processing

From instant impecuniosity verification to comprehensive fraud detection, Atto addresses the core challenges that slow down claims processing and increase operational costs.

Immediate assessment

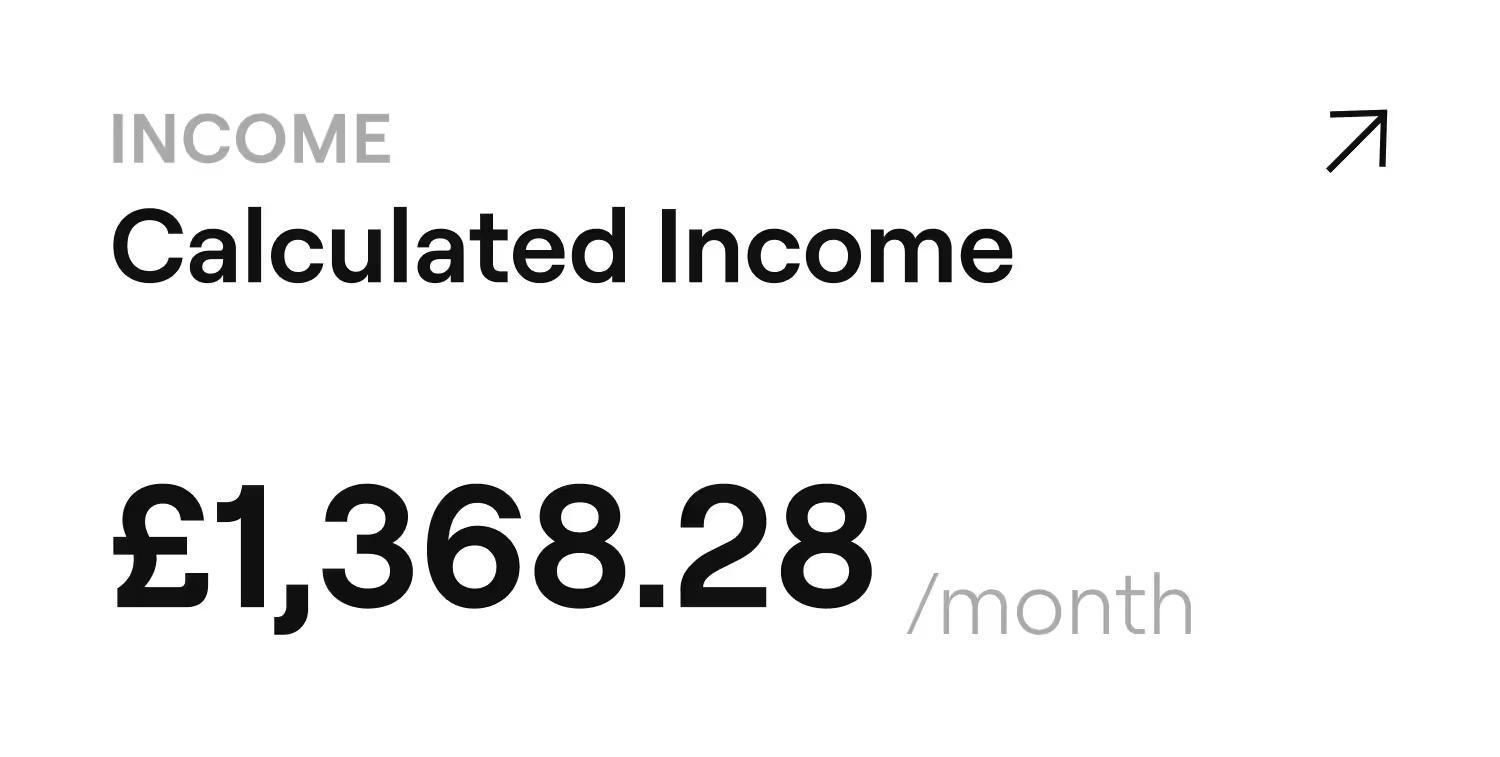

Make quicker, more confident affordability decisions

Eliminate lengthy document collection and manual verification processes. Atto bridges the gap between historical credit data and real-time financial behaviour, providing clear evidence of impecuniosity or ability to pay.

Make confident hiring decisions with comprehensive, up-to-date analysis that reduces disputes and strengthens claims outcomes.

Immediate assessment

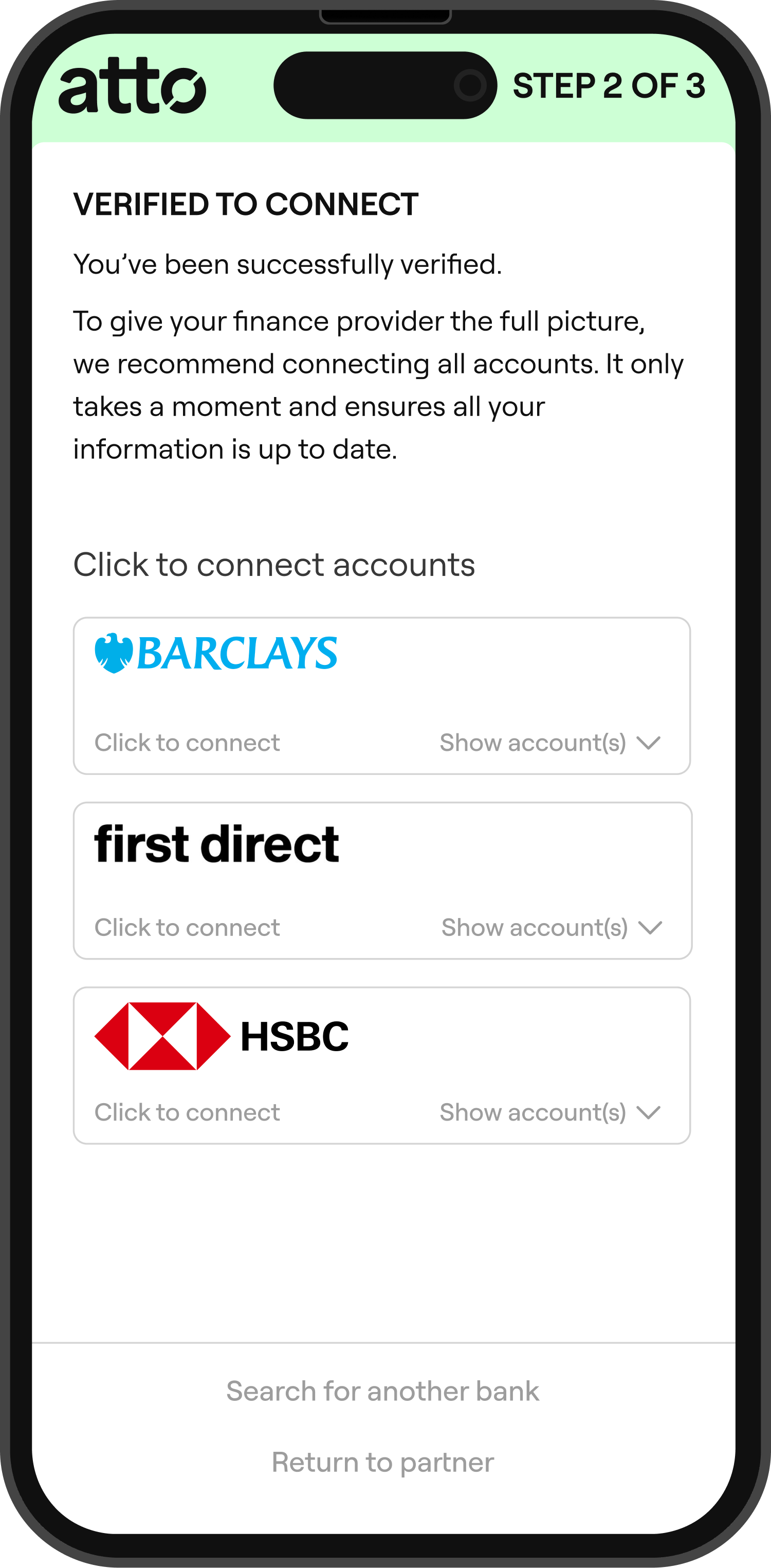

See every account before any connections are made

Connect reveals all accounts on a claimant's credit file instantly - current accounts, credit cards, loans, mortgages, and BNPL products. No more wondering about hidden accounts.

Verify complete financial circumstances upfront, then guide claimants to connect all relevant accounts via secure open banking.

Immediate assessment

Identify fraudulent claims before they escalate

Advanced algorithms analyse spending patterns, income consistency, and financial behaviour to flag suspicious claims. Substantially reduce fraudulent claim rates and protect your organisation from costly false impecuniosity declarations.

Immediate assessment

Complete financial assessments in hours, not weeks

Real-time data access eliminates waiting for bank statements and payslips. Process legitimate claims much faster whilst maintaining thorough due diligence.

Complete account discovery through Connect, combined with real-time transaction data, removes blind spots in customer profiles and enables comprehensive financial assessment in a single session.

Immediate assessment

Calculate true payment capacity with precision

Go beyond basic income verification to understand complete financial circumstances. Analyse fixed expenses, discretionary income, and spending patterns across all known accounts to accurately assess whether claimants can afford alternative vehicle arrangements.

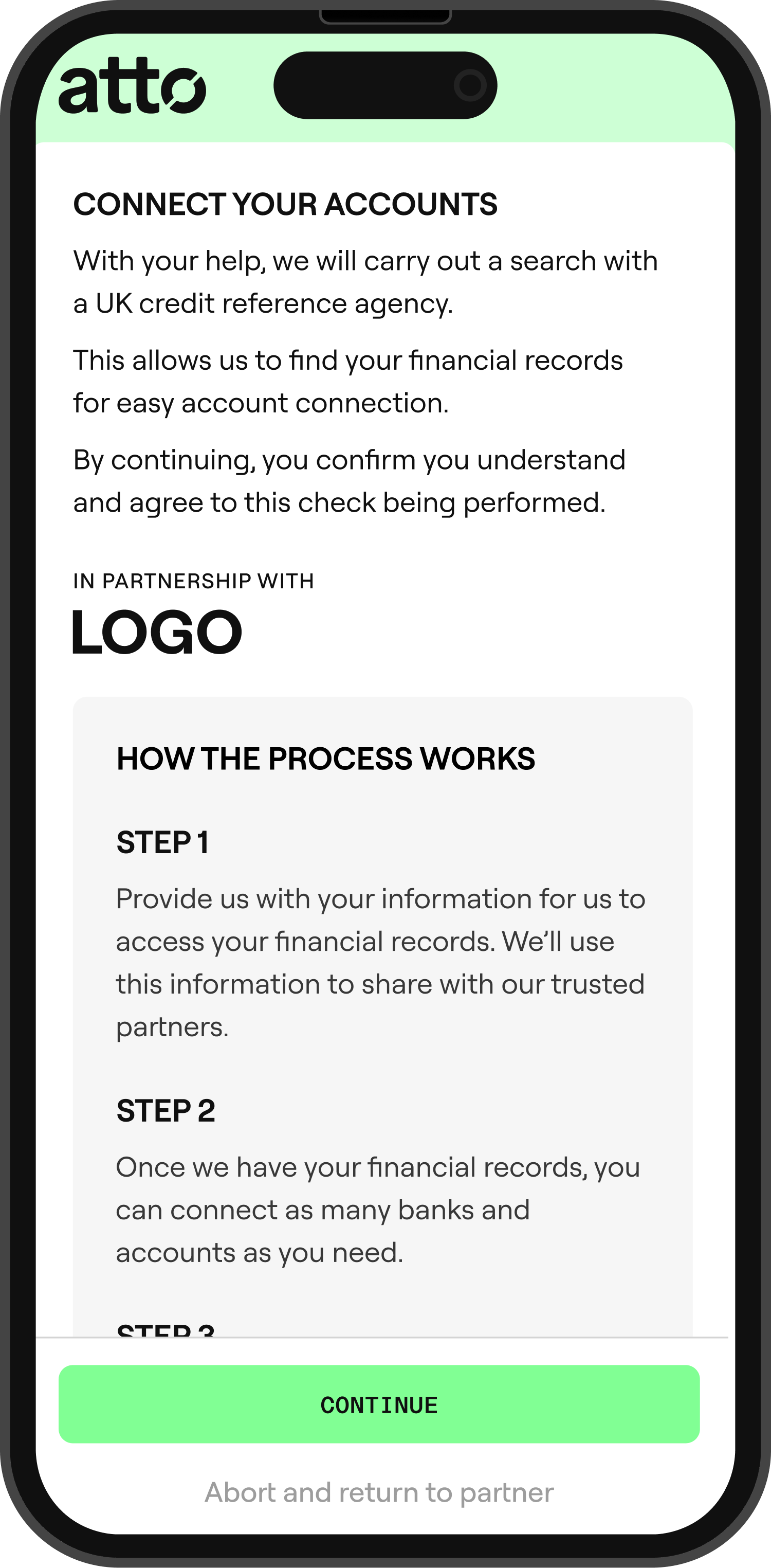

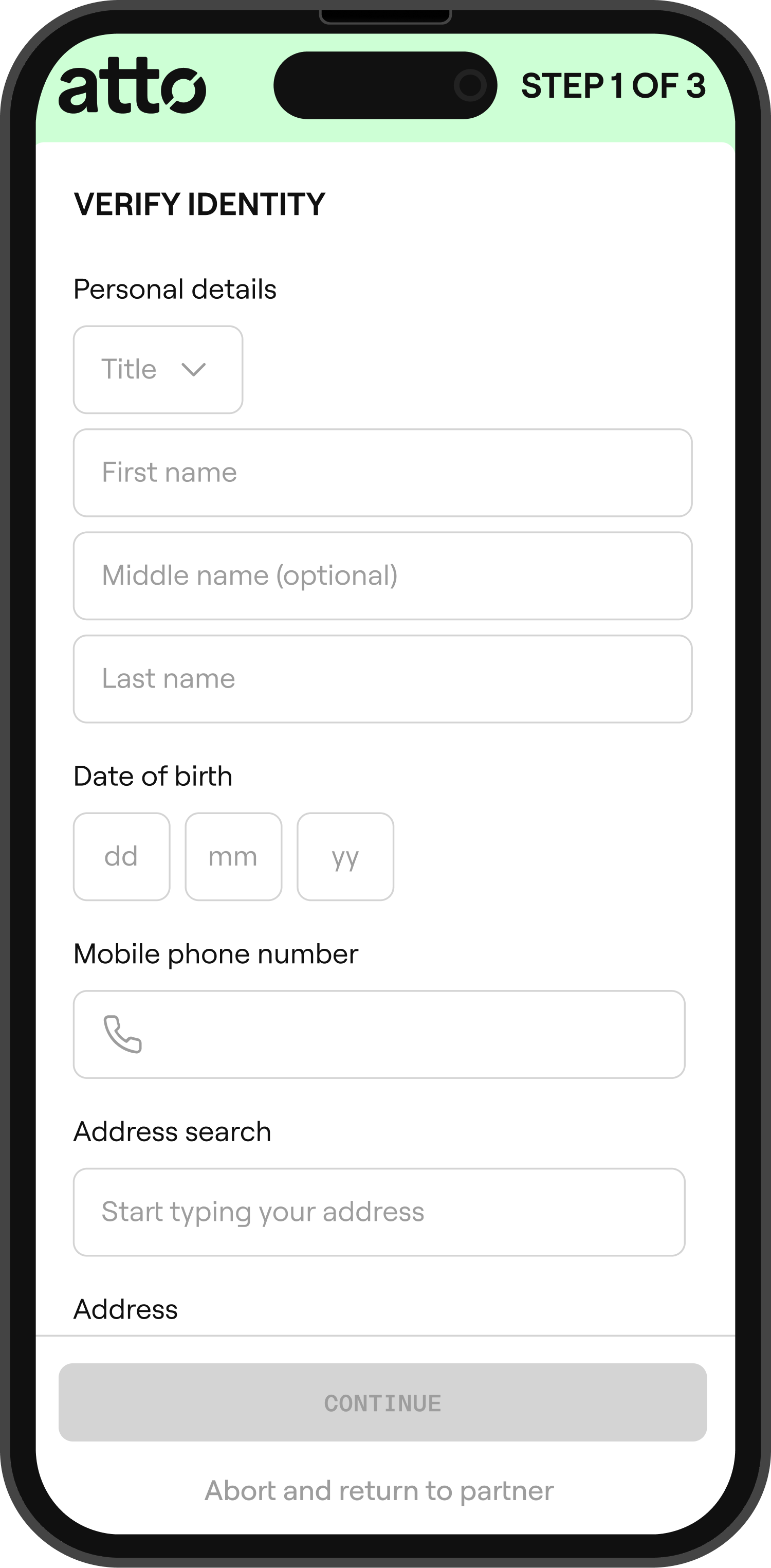

Simple process

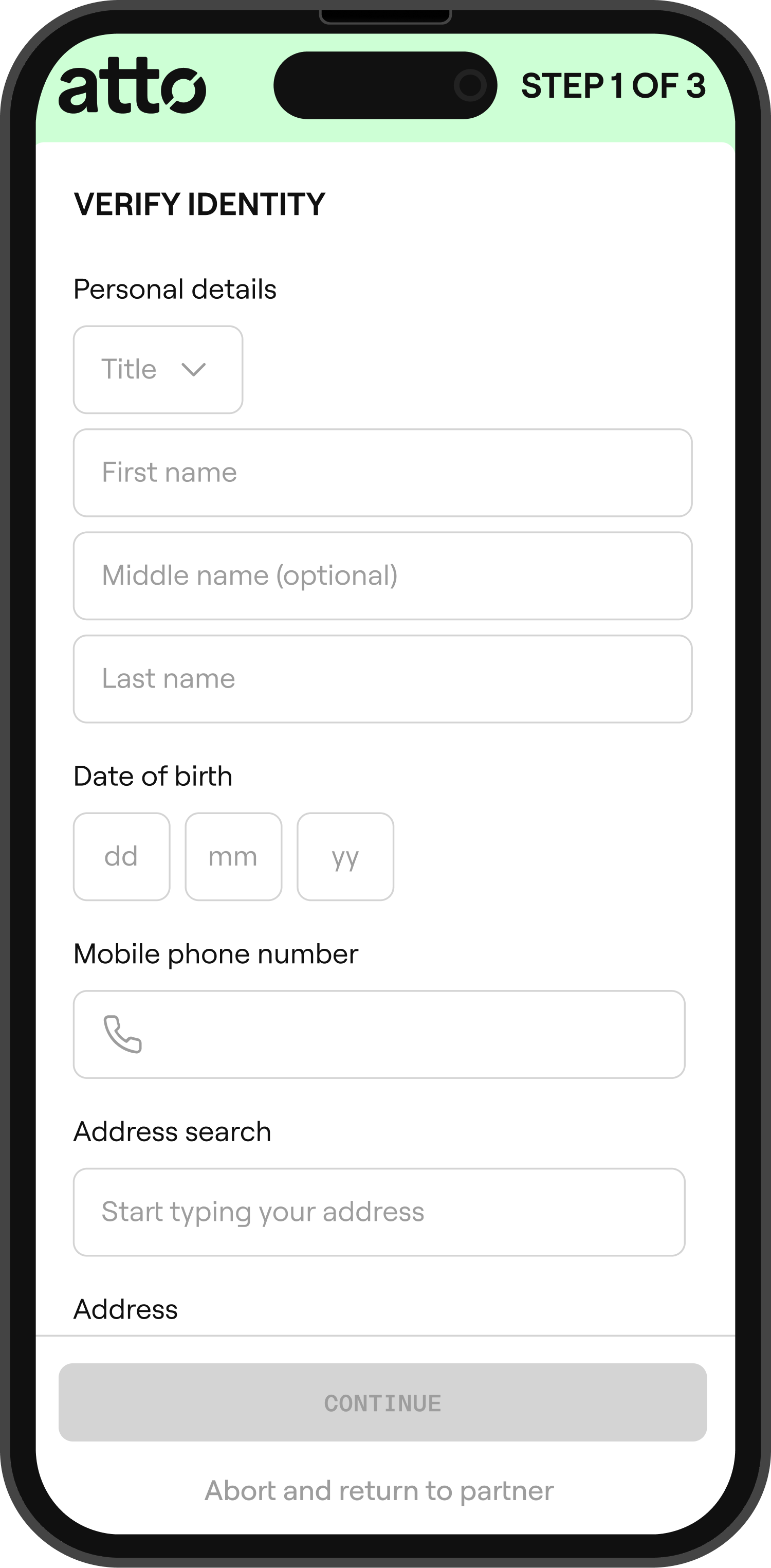

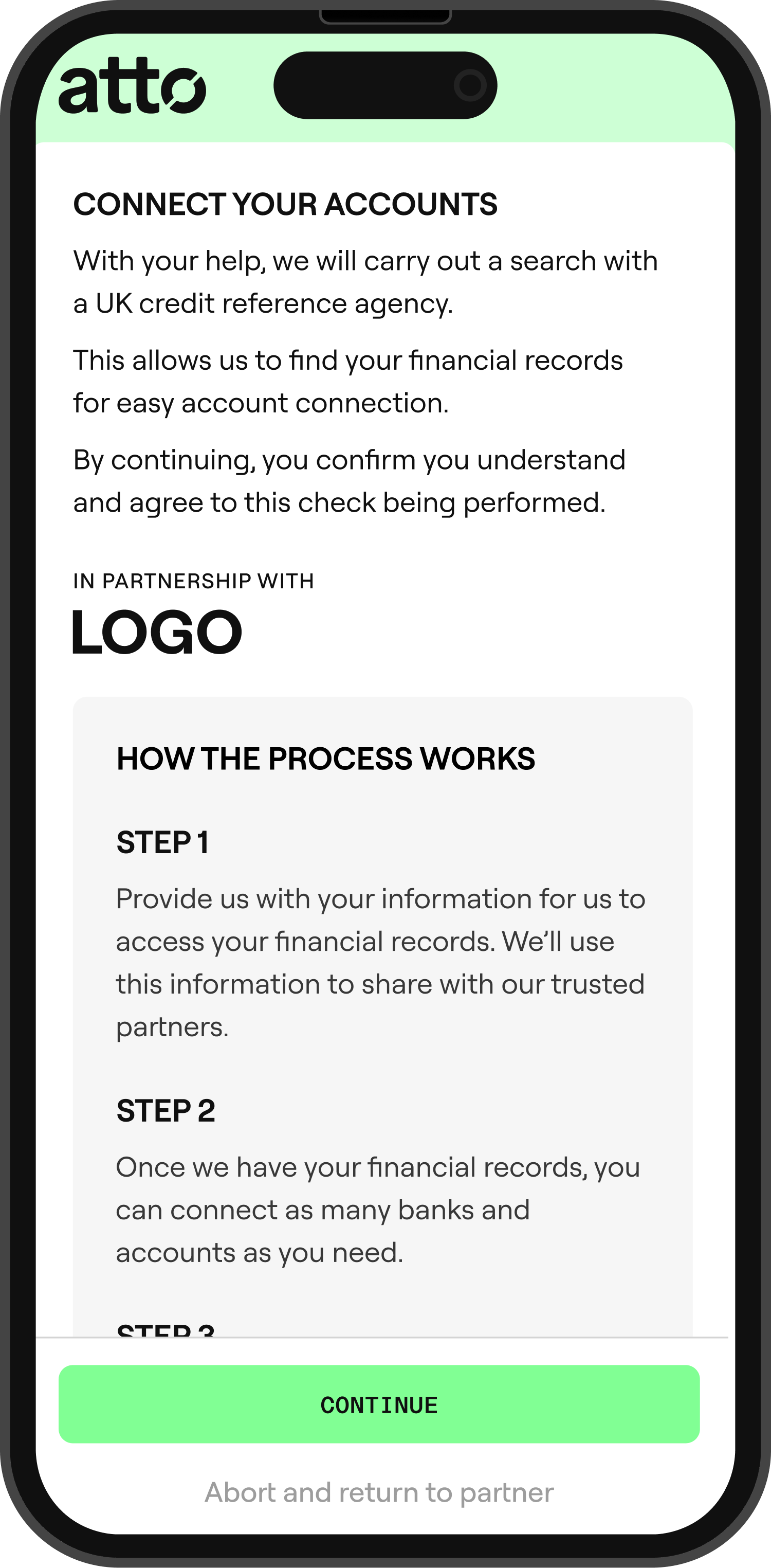

Three steps to complete financial verification

Our streamlined process transforms complex financial verification into a simple, secure, and instant experience for both CHOs and claimants, combining account discovery with real-time transaction analysis.

In partnership with TransUnion

Instant visibility of all claimant accounts

Identity verification through Connect accesses TransUnion's database to reveal every account on the claimant's credit file - current accounts, credit cards, savings, loans, mortgages, and BNPL products.

See the complete financial picture upfront, including accounts not eligible for open banking connection.

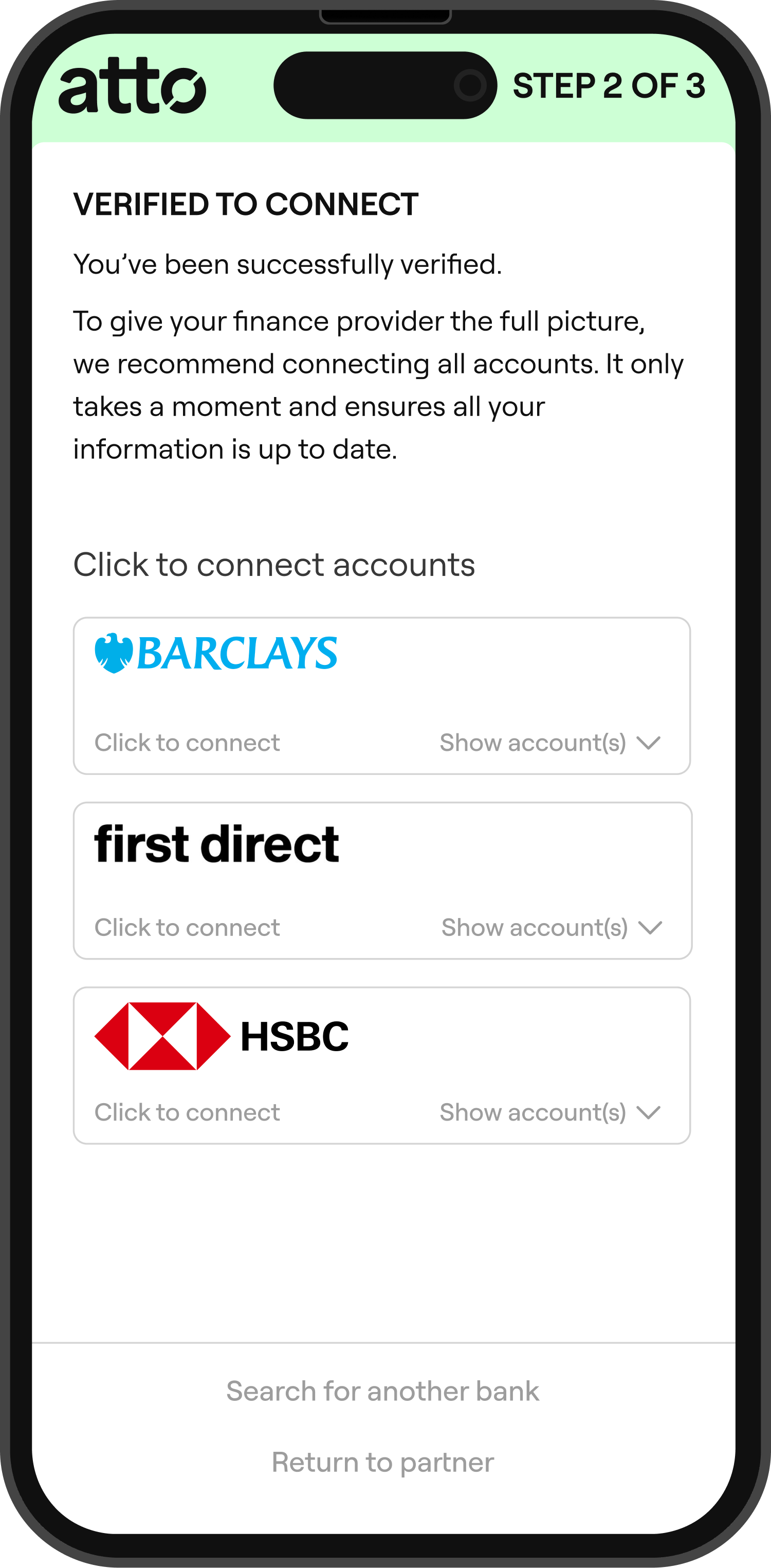

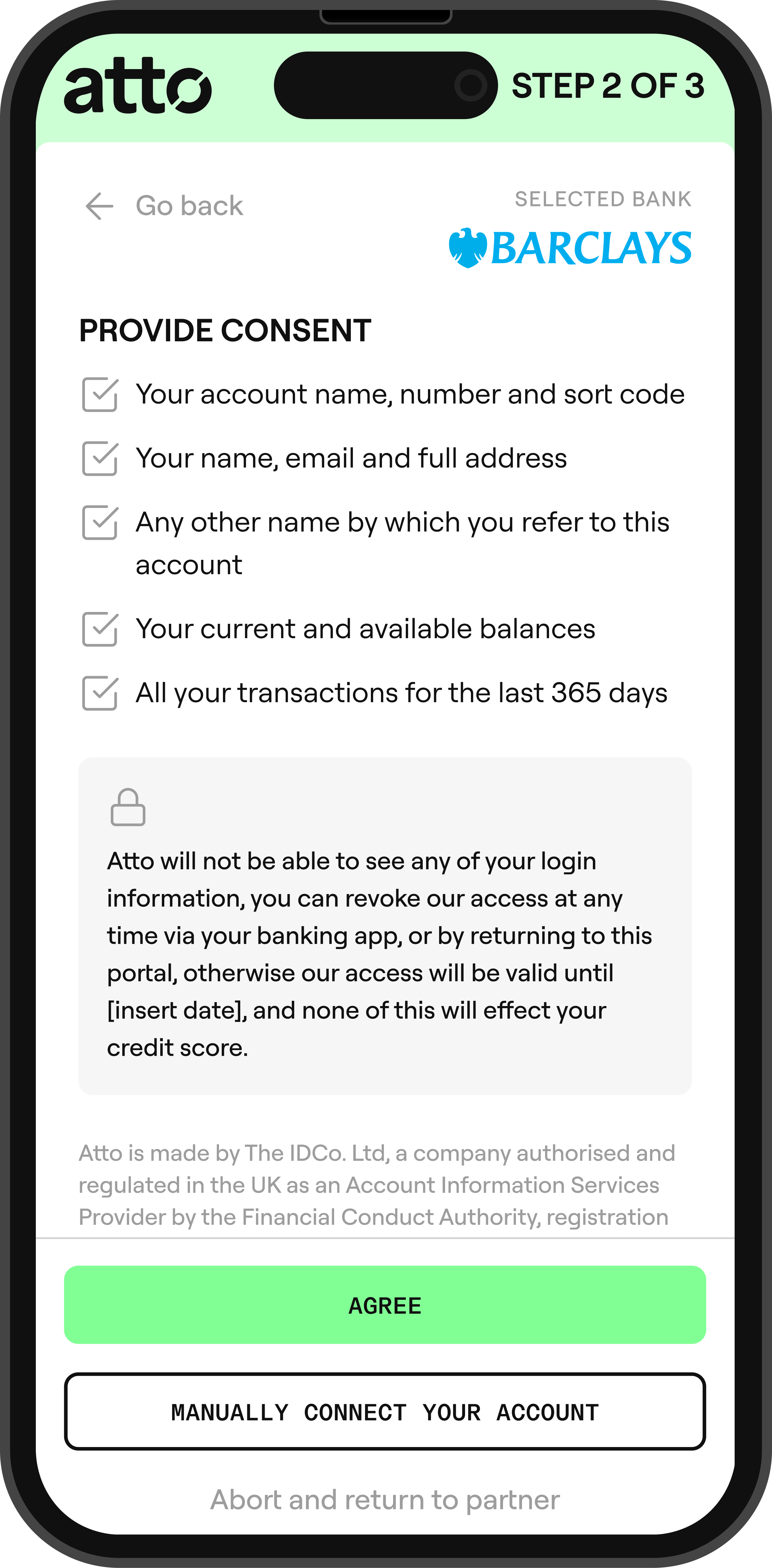

Seamless open banking connections in 30 seconds

Claimants connect eligible accounts through our secure open banking journey. Pre-populated account lists from Connect's account discovery (sourced from TransUnion) ensure nothing is missed.

Bank-level security protects all data throughout the connection process, with up to 12 months of transaction history available for analysis.

Complete financial intelligence, exportable in seconds

Access enriched transaction data, comprehensive financial reports, and advanced insights through our dashboard or APIs.

View income verification, spending analysis, affordability calculations, and fraud risk assessments. Export everything as a User Report PDF ready for legal review and court proceedings.

Versatile solutions

Tailored for everycredit hire scenario

Generate detailed User Reports combining account discovery with transaction analysis. Export comprehensive PDF documentation for legal teams, supporting transparent and defensible claims decisions with complete account visibility and court-ready evidence.

Versatile solutions

Vehicle accident claim processing

Instant financial background verification for accident victims claiming impecuniosity. Complete account discovery through Connect followed by real-time assessment of income, expenses, and affordability provides much clearer evidence for hire decisions whilst maintaining sensitivity to genuine financial hardship.

Versatile solutions

Rental vehicle authorisation

Rapid financial assessment for temporary vehicle provision. Atto's account discovery, income verification, affordability calculation, and risk assessment enable much faster decisions on rental vehicle approval whilst protecting against fraudulent claims.

Versatile solutions

Complex multi-party claims

Detailed financial profiling for contested claims involving multiple parties. Complete account visibility through Atto, cross-reference income sources, validate financial circumstances, and export User Reports as comprehensive evidence for legal proceedings and settlement negotiations.

Versatile solutions

Identify unviable claims before investing resources

Quick financial verification before committing to costly court cases. Complete account discovery through Connect enables pre-assessment teams to verify whether claimants' declared financial circumstances match their actual account activity and spending patterns.

Identify inconsistencies between stated income and real deposits, spot undisclosed accounts, and assess genuine financial hardship within minutes rather than weeks of investigation before deciding whether to pursue claims through court.

Bank-level security

Complete data protection and regulatory compliance

Servicing our customers

“Working together, Atto’s Connect widget and Shieldpay's payment engine allow customers to transfer funds online with digital escrow and trust services. The combined service will bring seamless identity verification during transfers, streamlining the customer experience without sacrificing any measure of security. Bringing customers a frictionless payments journey at every step.”

“We reduced claimant onboarding from 10 days to under 24 hours. Before open banking, we relied on Form of Authority letters and manual bank statement collection. The back and forth took weeks. Now we have complete financial verification in a single session.”

UK Credit Hire Organisation“Underwriters can confidently produce quicker and more detailed analysis. Customers receive speedier decisions with reduced intrusion/inconvenience. Dealer receives quicker decision - increased satisfaction. Everyone wins with the new process.”

Global automotive manufacturer

Powering household names with real-time customer insights

Book a demo

Prove impecuniosity in minutes

Ready to transform your credit hire claims processing with complete account visibility, real-time financial verification, and court-ready PDF documentation?

Join leading CHOs who've revolutionised their claims assessment with Atto's open banking technology and TransUnion integration.

Want to see it in action? Book a demo with our team.

In partnership with TransUnion